Visual Voice News

Is it late to start investing in cryptocurrency at 34 years old?

Oh honey, 34 is just the perfect age to dive into the exciting world of cryptocurrencies! You're never too late to start this digital financial rollercoaster. Trust me, your savvy 34-year-old self is just ripe for the crypto picking! Age is just a number, and in the crypto world, that number could turn into some major moolah. So, don your digital explorer hat and embark on this exhilarating crypto journey, because 34 is the new 24 in the crypto universe!

Why are most news websites charging a subscription fee?

News websites are increasingly charging subscription fees, and there are a few reasons why. The main reason is to generate revenue, as traditional advertising revenues have plummeted with the rise of ad-blockers and shifts in advertising trends. Subscriptions also provide a more stable and predictable income stream, which helps these outlets plan and budget better. Additionally, charging a fee can often lead to a higher quality of journalism, as it lessens the reliance on clickbait headlines. So, while it might be frustrating to hit a paywall, remember that your subscription is helping to support quality journalism.

What are the best sites for Indian news?

In my quest to stay updated with the latest happenings in India, I've come across several impressive news sites. Some of the best ones include The Hindu, NDTV, Times of India, and Indian Express, all offering comprehensive coverage on various topics. Hindustan Times and India Today are also noteworthy for their balanced reporting and in-depth analyses. Websites like Firstpost and Scroll.in provide unique perspectives, making them worth checking out. For regional news, sites like Dainik Bhaskar and Lokmat are quite reliable.

What is the best website for financial news?

In my quest to find the best website for financial news, I've concluded that Bloomberg stands out from the rest. I found its coverage to be expansive and in-depth, covering both global and local financial trends. Its user-friendly interface, coupled with its analytical tools, offers an enriching user experience. Additionally, Bloomberg's frequent updates ensure that you're always up-to-date with the latest financial news. In my opinion, for anyone interested in finance, Bloomberg is a must-visit website.

Why is central banking kept so secret?

Central banking is a highly secretive system of managing a country's finances and money supply. This system has been kept secret for a number of reasons, including the need to protect the financial system from external influence and manipulation, the importance of maintaining public confidence and preventing panic, and the need to maintain the stability of the currency. Central banks also have an important role in setting economic policy, and this too is kept secret to prevent any potential manipulation and to maintain the central bank's independence. Finally, central banking is also kept secret to limit the public's access to information about the economy and the markets.

Which are the best news app for an android phone?

This article explores the best news apps for Android phones. It lists the top apps in news and media, including Flipboard, Feedly, Google News, and Apple News. Each app is described in terms of features, user interface, and content availability. Additionally, the article provides tips on how to customize the app to best suit your needs. In conclusion, the article recommends Flipboard, Feedly, Google News, and Apple News as the best news apps for Android phones.

How could I open something like Chuck E Cheese?

Chuck E Cheese is a popular family entertainment center that offers a variety of fun activities for kids. Opening a Chuck E Cheese franchise requires a significant investment in time and money, and involves going through a rigorous application process. To get started, potential franchisees must have a strong business plan and a minimum of $750,000 in liquid assets. Additionally, they must possess the necessary skills and experience to manage a profitable business. Once approved, the franchisee must work with Chuck E Cheese to complete the setup process, including setting up a store location, obtaining permits, and hiring staff. With the right resources and commitment, opening a Chuck E Cheese franchise can be a rewarding experience.

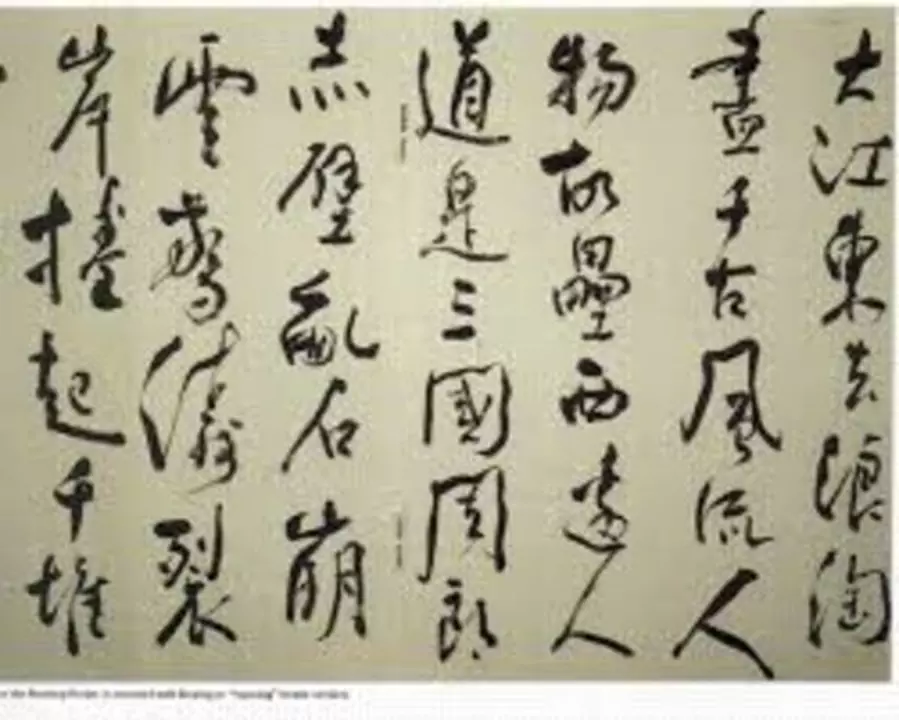

Where did the Chinese system of writing come from?

The Chinese system of writing is one of the oldest writing systems known to man, with roots going back to the Shang Dynasty (1600-1046 BC). It is a logographic writing system, meaning that each character represents a word or an idea, rather than a single sound. This system of writing has been passed down through generations and is still in use today. It is considered one of the most complex writing systems in history and is composed of thousands of characters. Chinese writing has had a profound influence on other writing systems in East Asia, and its influence continues to be felt in modern times.

Which is the best way to learn about stocks?

In my experience, the best way to learn about stocks is through a combination of research, online courses, and hands-on practice. I found that reading financial news and books from successful investors provided me with a solid foundation. Additionally, enrolling in online courses helped me understand the technical aspects of the stock market. Lastly, using virtual trading platforms to practice buying and selling stocks allowed me to apply my knowledge in a safe environment. Ultimately, patience and persistence are key to mastering the art of trading stocks.

In Jharkhand, women selling liquor to feed family have way out?

In Jharkhand, I came across an intriguing situation where women have resorted to selling liquor in order to provide for their families. It's a tough choice for these women, who are often faced with financial difficulties and limited job opportunities. However, there seems to be a glimmer of hope for them as various initiatives are being introduced to provide alternative livelihoods. Programs focusing on skills training and self-help groups are being implemented to empower these women and help them break free from the shackles of alcohol sales. While it's still a long road ahead, it's heartening to see that there are efforts being made to improve the lives of these women and their families.