New bill suggests 10-year jail for stashing illicit money abroad

- Comments::DISQUS_COMMENTS

New Delhi: Union Finance Minister Arun Jaitley on Friday introduced a Bill in the Lok Sabha that calls for a 10-year jail term and 90 per cent tax of the undisclosed income for those stashing illicit wealth abroad.

The Undisclosed Foreign Income and Assets (Imposition of Tax) Bill, 2015, also provides a window to persons seeking to come clean on such assets.

It also provides for separate taxation of any undisclosed income in relation to foreign income and assets.

Such income will henceforth not be taxed under the Income Tax (I-T) Act.

According to the Bill, undisclosed foreign income or assets shall be taxed at a flat rate of 30 per cent.

There will be no exemption, deduction or set-off of any carried-forward losses permissible under the existing I-T Act.

The penalty for non-disclosure of income or asset outside India will be three times the amount of tax payable thereon or 90 per cent of the undisclosed income or the value of the asset.

This is in addition to tax payable at 30 per cent.

The failure to furnish return on foreign income or assets will entail a penalty of Rs 10 lakh.

Wilful attempt to evade tax in relation to foreign income or asset will attract a rigorous imprisonment of 3-10 years and plus a fine.

Failure to furnish a return will be punishable with 6 months’ to 7 years’ jail term.

The Bill, however, proposes a limited window to persons who have any undisclosed foreign assets who wish to come clean.

“Such persons may file a declaration before the specified tax authority within a specified period, followed by payment of tax at the rate of 30 per cent and an equal amount by way of penalty,” Jaitley said in the statement of objects and reasons appended to the Bill.

The statement also said that the declaration made by such a person will not be used as evidence against him in the Wealth Tax, Foreign Exchange Management Tax, the Companies Act or the Customs Act.

The bill, however, seeks to protect persons holding foreign accounts with minor balances that may not have been reported out of oversight or ignorance.

It states that failure to report bank accounts with a maximum balance of Rs 5 lakh at any time in the year will not entail penalty or prosecution.

The Undisclosed Foreign Income and Assets (Imposition of Tax) Bill, 2015, also provides a window to persons seeking to come clean on such assets.

It also provides for separate taxation of any undisclosed income in relation to foreign income and assets.

Such income will henceforth not be taxed under the Income Tax (I-T) Act.

According to the Bill, undisclosed foreign income or assets shall be taxed at a flat rate of 30 per cent.

There will be no exemption, deduction or set-off of any carried-forward losses permissible under the existing I-T Act.

The penalty for non-disclosure of income or asset outside India will be three times the amount of tax payable thereon or 90 per cent of the undisclosed income or the value of the asset.

This is in addition to tax payable at 30 per cent.

The failure to furnish return on foreign income or assets will entail a penalty of Rs 10 lakh.

Wilful attempt to evade tax in relation to foreign income or asset will attract a rigorous imprisonment of 3-10 years and plus a fine.

Failure to furnish a return will be punishable with 6 months’ to 7 years’ jail term.

The Bill, however, proposes a limited window to persons who have any undisclosed foreign assets who wish to come clean.

“Such persons may file a declaration before the specified tax authority within a specified period, followed by payment of tax at the rate of 30 per cent and an equal amount by way of penalty,” Jaitley said in the statement of objects and reasons appended to the Bill.

The statement also said that the declaration made by such a person will not be used as evidence against him in the Wealth Tax, Foreign Exchange Management Tax, the Companies Act or the Customs Act.

The bill, however, seeks to protect persons holding foreign accounts with minor balances that may not have been reported out of oversight or ignorance.

It states that failure to report bank accounts with a maximum balance of Rs 5 lakh at any time in the year will not entail penalty or prosecution.

Related items

-

Blunder! Middle class family gets Rs 55 crore electricity bill

Blunder! Middle class family gets Rs 55 crore electricity bill

-

Cabinet approves Bill to unearth black money

Cabinet approves Bill to unearth black money

-

Mangaluru to get SMS alerts under new water billing system

Mangaluru to get SMS alerts under new water billing system

-

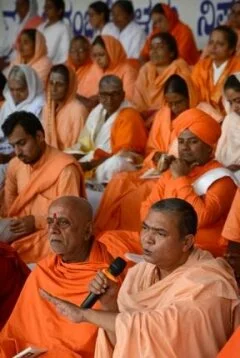

Seers demand implementation of anti superstition bill

Seers demand implementation of anti superstition bill